What is General-Purpose Financial Reporting?

A Guide for Accountants and Financial Professionals on the Objective of General-Purpose Financial Reporting

Have you ever paused during your daily work, stared at a financial report, and asked yourself,

"What’s the real purpose of preparing all these statements?

Why am I doing this every month, quarter, and year?"

I’ve been there too. Early in my career, I knew how to prepare a balance sheet or profit and loss report—but I didn’t really understand why we were doing it beyond compliance or reporting to the boss. It wasn’t until I started working in a multinational company and interacting with management directly that the true purpose of general-purpose financial reporting hit me.

So today, I want to take you deeper into this concept. Not from a textbook point of view, but from a real, working accountant’s lens, and this post can help you to get more clarity on what to learn next or how to grow in your finance career.

🔍 What is General-Purpose Financial Reporting, Really?

In simple terms, general-purpose financial reporting is about providing useful financial information to people outside the company like investors, lenders, or regulators - so they can make smart decisions about giving or continuing to give their resources to the business, like Investing or giving loans for business.

These are not customized reports. These are standard financial statements prepared for everyone who may have a stake in the company but doesn’t have internal access to management. Think of them as the company’s "financial CV" shared with the public.

💡 Why is This Reporting So Important?

The reason is simple, Because money follows trust. And trust comes from clarity.

Let’s say, If I’m an investor, The initial things I would like to know are:

What assets does this business have?

What are its liabilities and obligations?

Is the company profitable?

Can it repay its debts?

Will I earn a good return if I invest in it?

Without clear, consistent, and structured reporting, no one will invest or lend. That’s why IFRS (for global companies) and US GAAP (for US companies) exist - to ensure that we accountants speak a common language. We will talk about both in our future blogs.

📊 What Kind of Information Does General-Purpose Reporting Provide?

There are three key areas that general-purpose financial statements focus on:

1. Economic Resources and Claims (Balance Sheet)

This includes everything the business owns and owes—its assets, liabilities, and equity.

🔎 Why this matters: It helps stakeholders evaluate the business's liquidity, solvency, and financial strength.

✅ For Example: Let’s say your company is applying for a bank loan. The banker will look at the general-purpose balance sheet to assess your debt-to-equity ratio and whether you have enough current assets to cover your liabilities.

2. Changes in Resources and Claims (Income Statement & Statement of Equity)

These show how the business’s position has changed over a period—through profits earned, losses suffered, dividends paid, or new shares issued.

🔎 Why this matters: It shows how the company is performing over time.

✅ For Example: An investor tracking your company over three years will look at the trend in net profits, revenue growth, and retained earnings to decide whether to hold or sell shares.

3. Cash Flows (Cash Flow Statement)

This explains where the cash is coming from and where it’s going—whether through operating, investing, or financing activities.

🔎 Why this matters: Even profitable businesses can fail without cash.

✅ For Example: Suppose your company is showing profit but is constantly borrowing money. A detailed cash flow report can show if that profit is real or just on paper.

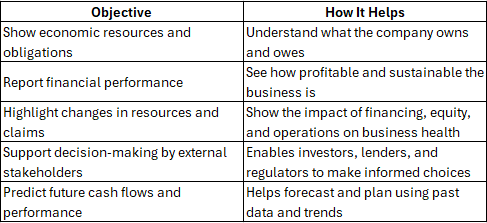

📌 What’s the Core Objective?

You might be thinking okay, I get it but what is the objective behind doing all this.

The core objective is to help external users make decisions about providing resources whether it's buying shares, giving loans, or continuing partnerships. They are putting their hard earned money, so they have right to know important things about the company they are investing in. Don’t you think they must? Of course, yes. Here they get help from General-Purpose Reporting.

And there is one more thing I’ve learned is that,

These reports aren’t just for outsiders. They’re powerful decision-making tools for us too - Accountants, Finance Managers, CFOs, and Finance Teams.

🧠 How Can You Apply This Insight in Your Daily Work?

Now here it goes little practical. Here’s how we can start applying this mindset:

Stop Preparing Reports Just to 'Submit'

Start thinking from the lens of the user of the report—What will they look for? What questions will they ask? Prepare proactively.Make Clarity Your Priority

Use consistent formats, remove clutter, and highlight key metrics. Whether your boss is a finance expert or not, your job is to tell the business story clearly.Focus on Forward Use, Not Just Backward Reporting

While past data is important, always ask: How will this help someone make a future decision?Ask Better Questions in Review Meetings

When reviewing financials, don’t just say “Revenue increased by 10%.” Ask:

– Is it sustainable?

– What drove the change?

– What’s the outlook next quarter?

This is how we move from number crunchers to decision influencers.

💼 A Real-Life Example: From Task-Doer to Strategic Thinker

A few years back, one of my friends shared an experience. He worked with a mid-sized firm that was struggling with liquidity. Every month, the reports were being prepared “as usual,” but no one truly analyzed the trends.

When he stepped in, He began highlighting specific KPIs that linked resources to performance - working capital ratios, receivables aging, and debt covenants. They discovered the company was profitable but bleeding cash due to bad credit terms and bloated inventory.

By sharing this through clear, general-purpose financial reports, the owners restructured their credit policies and inventory model. Six months later, they turned around their cash flow position.

That’s the power of understanding the objective behind financial reporting.

📘 Quick Recap

Here’s the table which you can refer for your learning: -

🗝 The Key: -

If you're someone who's stuck doing reporting because it's part of the job, let me invite you to pause and rethink.

Understanding why we prepare these reports can transform how you work and how you're perceived in your organization.

This is what we do at The Accountant Hub - we go beyond technical tasks and focus on building clarity, confidence, and career growth for accounting and finance professionals.

If this blog resonated with you, I invite you to join our VIP inner circle - a growing tribe of ambitious, driven professionals who are committed to mastering accounting, building careers, and becoming decision-makers, not just doers.

Let’s grow together.

🔗 [Join the VIP Community of The Accountant Hub]

With clarity,

Your Friend

Divyesh Dave

The Accountant Hub