What do you know about IFRS?

A quick guide about International Financial Reporting Standards

A comprehensive guide for Accounting and Finance Professionals

Hello, fellow accounting and finance professionals! 👋 This is your friend Divyesh Dave again, and today, I want to share some key insights about International Financial Reporting Standards (IFRS), which I am learning at my own pace. If you are someone, working in a multinational corporation (MNC) or wish to work you must learn to enhance your financial reporting skills. which is crucial in shaping a global career.

Let’s explore IFRS together with some basic understanding which I know can be helpful in our daily professional lives. Whether you’re a seasoned accountant or just starting in your career, I’ll break this down in a way that’s simple and relatable.

What is IFRS?

In simple terms, IFRS is like the universal language of accounting for multinational companies. It provides a consistent framework for preparing and presenting financial statements, making it easier for businesses and investors across the globe to understand and compare financial information.

When I first read about IFRS, I noticed how it bridged the gap between teams across different countries. It helps in collaboration and reduces the confusion caused by differing local accounting standards. Because every country has their own Standards of accounting and financial reporting, how than a global company come to a common stage?

Do you know how?

By using common financial reporting standards, here comes the role of IFRS.

Transition From IAS to IFRS

You may have heard of International Accounting Standards (IAS), which were introduced in 1973 by the International Accounting Standards Committee (IASC). These standards served as the foundation for IFRS.

In 2001, the International Accounting Standards Board (IASB) took over and began issuing IFRS to replace IAS gradually. Think of it as an upgrade to meet the growing needs of global businesses. This is another board like FASB of the US.

For example:

IAS 17, which dealt with leases, was replaced by IFRS 16, offering a more comprehensive approach to lease accounting.

Why IFRS Matters in a Globalized World

Working in a multinational company, you might deal with clients and subsidiaries from Europe, Asia, Africa or other places. IFRS ensures that all stakeholders, regardless of their location, can understand financial statements without needing a "translation."

It means you can check the different financial data in the same format if you apply IFRS.

It not only helps the external users but also the company itself for better decision-making.

Just think, your subsidiary in the UK making financial in their local standards, and your other subsidiary in South Africa, using their accounting standards, which may show a different presentation. How will you be able to make a consolidation report? It will be so hard for everyone. That’s why everyone follows IFRS so it becomes easy to create, decide and interpret the financials.

Note: US Companies follow US GAAP, not IFRS.

Key Benefits of IFRS:

There are a few benefits of using IFRS like,

Global Comparability:

Imagine comparing the financial statements of a Dubai-based diamond company and a UK-based retail giant. IFRS makes this possible.

Transparency:

Clear and consistent financial reporting builds trust among investors, lenders, and other stakeholders.

Ease of Cross-Border Deals:

Whether it's mergers, acquisitions, or joint ventures, IFRS simplifies the due diligence process.

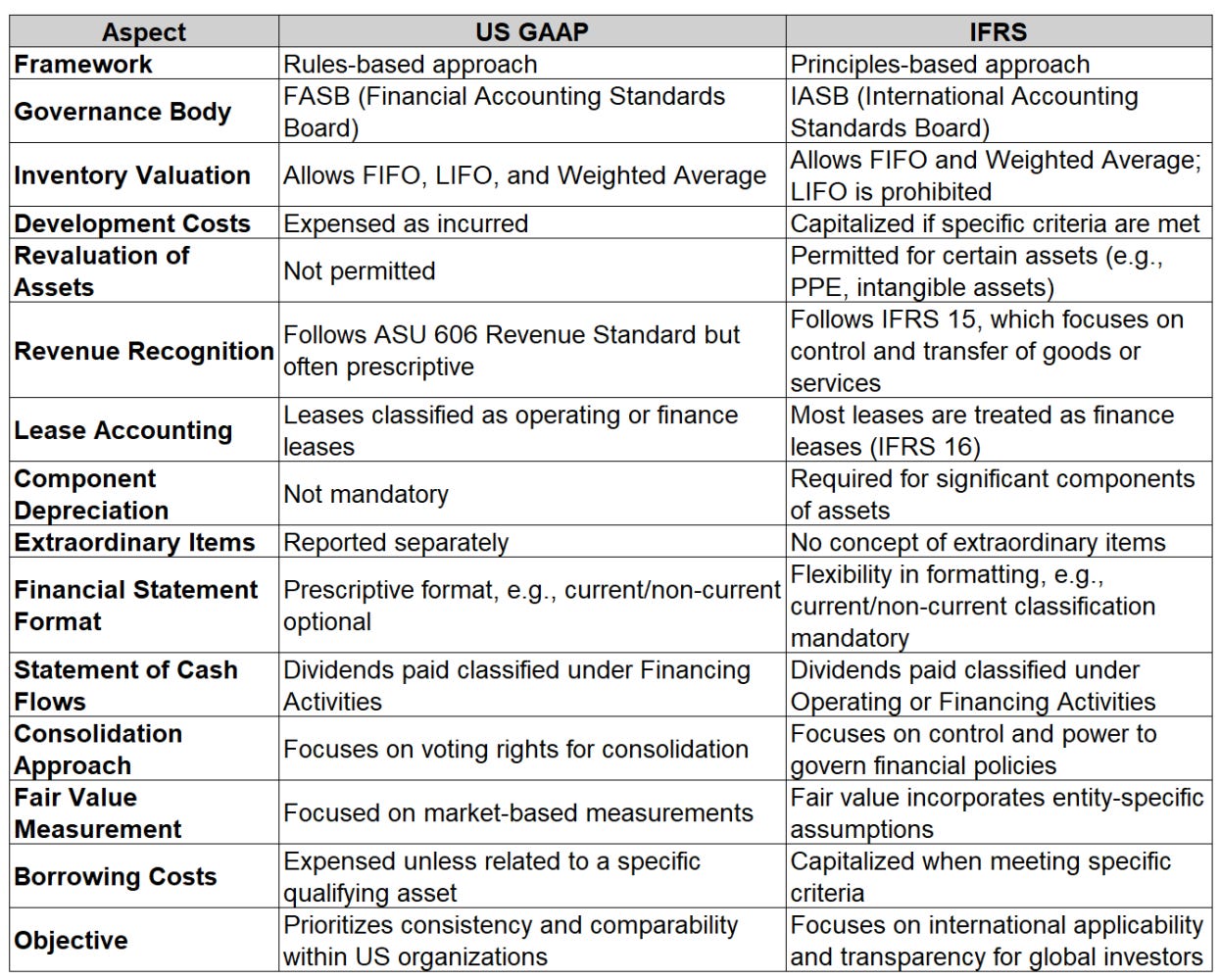

IFRS vs. US GAAP: What’s the Difference?

As professionals, you might often hear comparisons between IFRS and US GAAP. There is a very simple difference you can say that all the companies based in the US must follow US GAAP and the rest of the world follow IFRS. but there are a few major differences, I would like to share with all of you which I read a few days ago.

Key Differences Between US GAAP and IFRS

Let me simplify the core purpose of this list, with one example:

Under IFRS, revenue recognition focuses on the substance of the transaction, while US GAAP provides detailed criteria for specific industries.

The choice between US GAAP and IFRS depends on:

Jurisdiction: IFRS is globally accepted in over 140 countries, while US GAAP is mandatory in the United States.

Industry: Certain industries (e.g., oil and gas) might prefer IFRS for its asset revaluation flexibility.

If you work in a multinational corporation or aspire to, understanding both frameworks is invaluable.

Is Your Company Required to Use IFRS?

If your company operates in a country that has adopted IFRS, then yes! IFRS is mandatory for:

Publicly listed companies in IFRS-compliant countries.

Multinational corporations operating in global markets.

Some SMEs, depending on local regulations.

Example:

A Dubai-based company listed on the London Stock Exchange must prepare its financials under IFRS to comply with UK regulations.

Key Principles of IFRS

Just like any national accounting standard, IFRS also have a few core and a few advanced and detailed principles. I would like to share a few with you here. Check and search more about them and if you are already implementing them, well thumbs up from my side.

The International Financial Reporting Standards (IFRS) are guided by several key principles that ensure transparency, consistency, and comparability in financial reporting. Let’s break them down with simple examples:

1. Accrual Basis of Accounting

Principle:

A company provides a service in December but receives payment in January. Under IFRS, the revenue is recognized in December, when the service was performed, rather than in January, when the cash was received.

2. Going Concern

Principle:

A retail business is reporting its financials. If management has no intention or need to liquidate or reduce operations significantly, the financial statements will reflect that the business is a going concern.

3. Fair Value Measurement

Principle:

A company owns an office building purchased 10 years ago for $1 million, but its current market value is $3 million. Under IFRS, the building can be revalued to reflect the fair value of $3 million.

4. Materiality

Principle:

A large corporation’s financial statement does not need to detail expenses for small items like office stationery, as these are insignificant to the overall financial picture.

5. Substance Over Form

Principle:

A company sells an asset to another company but enters into an agreement to lease it back for continued use. Even though the legal form suggests a sale, IFRS requires the transaction to be treated as a financing arrangement if the seller continues to control the asset.

6. Revenue Recognition (IFRS 15)

Principle:

An electronics company delivers laptops to a customer under a contract and sends the invoice. Revenue is recognized upon delivery, as the customer has control of the laptops, regardless of when payment is made.

7. Matching Principle

Principle:

A company hires a marketing agency to run a campaign for a product launch. The cost of the campaign is recognized in the same period as the revenue from the product sales.

8. Consistency

Principle:

If a company uses the straight-line depreciation method for its equipment, it must continue using the same method unless there is a valid reason for a change.

9. Prudence

Principle:

If there’s uncertainty about the collectability of a receivable, a company creates a provision for doubtful debts to reflect a more conservative view of financial health.

10. Comprehensive Income

Principle:

Gains or losses from foreign currency translation adjustments or revaluation of financial instruments are reported in other comprehensive income (OCI) instead of the income statement.

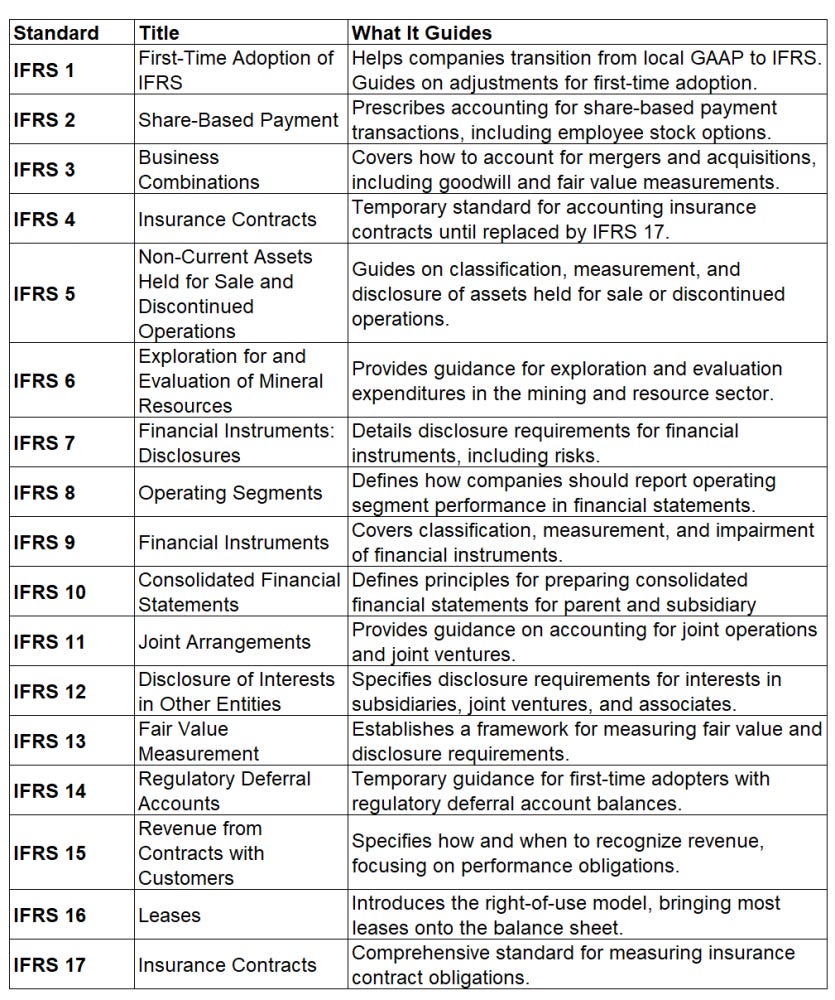

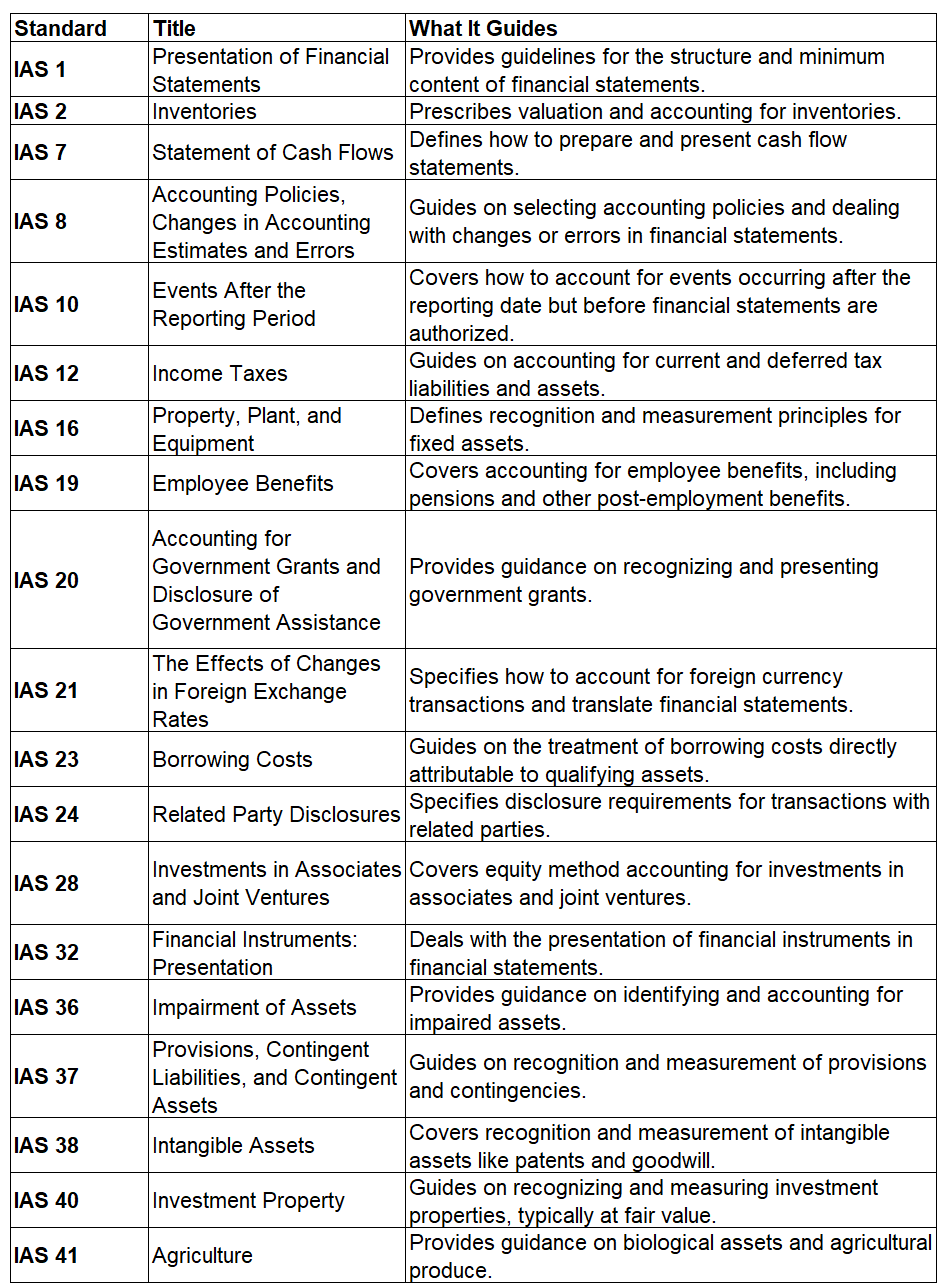

List of IFRS/IAS

Here’s a detailed list of all

IFRS Standards

IAS Standards

How These Standards Apply to Your Work

As an accountant or finance professional, understanding these standards is crucial.

For example:

IFRS 16 impacts lease accounting, requiring businesses to reflect operating leases on their balance sheet. This can significantly alter financial ratios.

IAS 36 ensures that businesses account for asset impairments promptly, protecting stakeholders from overestimating asset values.

Mastering these standards not only enhances your technical skills but also makes you a valuable asset to global organizations.

Challenges in Implementing IFRS

Implementing IFRS in an organization can be challenging but focus on learning. They are constantly evolving and updating the standards. So you can also stay updated if you keep learning about it.

If you are in the process of implementing IFRS in your organization, You or your team may need ;

Training from experts: Teams must be trained to understand and apply IFRS principles.

System Updates: ERP systems may need reconfiguration to align with IFRS.

Judgment Calls: IFRS’s principles-based approach requires more professional judgment, which can lead to inconsistencies.

Why IFRS Skills Are Crucial for Professionals

Mastering IFRS can open doors to global opportunities. As more countries adopt IFRS, professionals skilled in these standards will be in high demand.

How to Get Started:

Enroll in IFRS Certification Programs.

Stay Updated with IASB Updates.

Practice Real-Life Scenarios.

Let me give you a relatable example. Suppose you’re evaluating a company for investment. If their financials follow IFRS, you can trust that revenue recognition and asset valuation are consistent with global standards, making your decision-making easier.

In the end, I can add that as an accounts and finance professional, understanding IFRS is no longer optional; it’s essential now. Whether you’re preparing financials, auditing, or advising clients, IFRS equips you to operate confidently in a globalized world.

Tell me What has your experience been with IFRS? Do you face challenges or have success stories to share? Let’s discuss and learn from each other!

Now I hope this article helped you to have a basic understanding of IFRS.

let’s put your knowledge to the test! Here are a few questions to get you thinking:

Why is it important for companies to follow IFRS?

Which IFRS do you think is the most difficult one for you?

Join "The Accountant Hub" Community

For more in-depth discussions, interactive Q&As, and practical exercises, join The Accountant Hub community. We’re a group of professionals and learners dedicated to mastering accounting concepts and helping each other grow. Together, we can tackle complex topics like US GAAP and make them easy to understand and apply in real life!

Please join us and take your accounting skills to the next level!