The Three Types of Accounts Explained

From personal to real to nominal—discover the three pillars of accounting that simplify every journal entry.

When I first learned accounting, the debit and credit rules confused me like crazy. I remember thinking: Why do we debit some accounts and credit others? How do we decide?

Then my mentor told me something simple that changed everything:

👉 “First, know the type of account you are dealing with. Once you know the type, the golden rule will automatically tell you what to do.”

That’s when I realized the importance of Types of Accounts. They are like the traffic signals of accounting—guiding us on whether to debit or credit.

If you’re an accountant or finance professional, mastering this concept is not optional. It’s the foundation that gives you confidence in journal entries, reconciliations, and financial statements.

📖 What are the Types of Accounts?

You all know that we follow double-entry accounting. And, In double-entry accounting, every transaction affects two accounts. But not all accounts are the same, they fall into different categories.

There are three main types of accounts:

Personal Accounts

Real Accounts

Nominal Accounts

Each has its own rules, and once you understand them, journal entries become much easier.

🧩 1. Personal Accounts

Personal accounts relate to individuals, firms, or organizations with whom the business has financial dealings. In accounting, we treat these parties as separate entities, whether they are customers who owe us money, suppliers we need to pay, or banks holding our deposits. The idea is simple: when a transaction occurs, it involves people or organizations either giving something to the business or receiving something from it.

The entity concept we discussed earlier also applies here: the business and owner are separate. So even the owner’s capital or drawings are treated as personal accounts. Whenever money or value is given or received, personal accounts help us record who is involved in the transaction.

Let’s check what these are, for example:

These accounts are related to individuals, firms, or organizations. Like,

Natural Persons (living people):

Customers / Debtors

Suppliers / Creditors

Proprietor (Capital & Drawings)

Employees (Salary Payable, Advances to Employees)

Artificial Persons (organizations, institutions, companies):

Banks (Bank A/c)

Insurance Companies

Corporate Accounts (XYZ Pvt. Ltd., ABC Ltd.)

Government Accounts (Income Tax Dept., VAT Authorities)

Representative Personal Accounts (accounts representing a group or obligation):

Outstanding Salaries

Prepaid Rent

Accrued Income

Unearned Revenue

👉 Golden Rule for Personal Accounts:

Debit the receiver

Credit the giver

Example:

Customer (Debtor) paying us → Debit customer, Credit cash

Supplier (Creditor) receiving payment → Debit supplier, Credit cash

Let’s say, If your business pays ₹10,000 to a supplier:

The supplier (giver of goods earlier) is credited.

Cash (asset going out) is reduced.

Supplier A/c Dr 10,000

To Cash A/c 10,000🧩 2. Real Accounts

Real accounts relate to assets of the business—everything the business owns. These can be tangible (like machinery, land, furniture) or intangible (like goodwill, trademarks, patents). Unlike nominal accounts that are closed at year-end, real accounts are permanent accounts, carried forward from one accounting period to another.

The essence of real accounts is tracking what comes in and what goes out of the business. If you acquire an asset, it’s debited. If you dispose of it, it’s credited. Real accounts are the backbone of the balance sheet because they represent the financial resources of the business.

Let’s check what these are, for example:

These accounts are related to assets of the business. They can be tangible or intangible.

Tangible Assets (Physical items you can touch):

Cash

Furniture

Land & Buildings

Machinery & Equipment

Inventory / Stock

Vehicles

Intangible Assets (Non-physical but valuable):

Goodwill

Patents

Trademarks

Copyrights

Computer Software

Franchise Rights

👉 Golden Rule for Real Accounts:

Debit what comes in

Credit what goes out

Example:

Furniture purchased for the office → Debit furniture, Credit cash

Selling old machinery → Debit cash, Credit machinery

Let’s say, If you buy office furniture for ₹20,000 in cash:

Furniture A/c Dr 20,000

To Cash A/c 20,000🧩 3. Nominal Accounts

Nominal accounts capture the incomes, expenses, gains, and losses of a business. These accounts measure the business’s performance during a period. Unlike real accounts, nominal accounts do not carry balances into the next period—they are closed into the Profit & Loss account at year-end.

In simple terms, nominal accounts tell the story of profitability: money spent (expenses/losses) versus money earned (income/gains). For every debit entry (like salaries, rent, or electricity), there’s a credit entry (like service revenue, commission received, or interest income). These accounts help us answer the ultimate business question: Are we making a profit or loss?

Let’s check what these are, for example:

These accounts are related to expenses, losses, incomes, and gains.

Expenses & Losses:

Rent Expense

Salaries & Wages

Stationery Expense

Advertising & Marketing Expense

Electricity Bill

Insurance Expense

Bad Debts

Depreciation

Incomes & Gains:

Sales Revenue

Service Income

Commission Received

Interest Income

Dividend Income

Rent Received

Gain on Sale of Asset

👉 Golden Rule for Nominal Accounts:

Debit all expenses and losses

Credit all incomes and gains

Example:

Paying salaries → Debit salary expense, Credit cash

Receiving interest on deposits → Debit cash, Credit interest income

Let’s say, If you pay a salary of ₹15,000:

Salary Expense A/c Dr 15,000

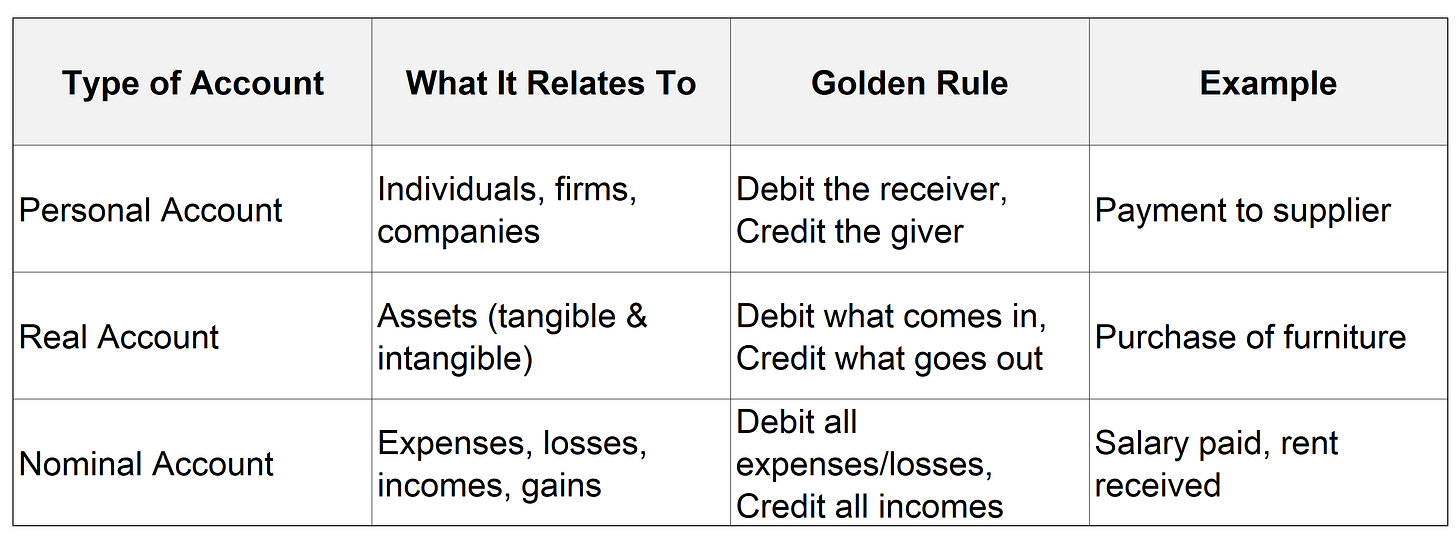

To Cash A/c 15,000📊 Short Summary

💼 Applying All 3 Types in One Transaction

Let’s say Tim (our car cleaning entrepreneur of Speedo Car Clearning Services) receives ₹50,000 from a customer for services.

Customer → Personal Account → Debit the receiver.

Cash → Real Account → Debit what comes in.

Service Revenue → Nominal Account → Credit income.

👉 Journal Entry:

Cash A/c Dr 50,000 (Real – what comes in)

To Service Revenue A/c 50,000 (Nominal – income earned)Did you Notice how understanding the account type makes applying the rule easy?

I hope it is clear now.

🚨 Few Common Mistakes Professionals Make

Mixing account types – e.g., treating owner’s drawings as expense (it’s personal, not nominal).

Forgetting intangible assets – Many ignore goodwill, trademarks, or patents under real accounts.

Confusing income with liability – e.g., advance received from a customer is a liability, not income yet.

Not closing nominal accounts – Expenses and incomes must be closed into Profit & Loss at year-end.

🧠 Why You Should Master This?

If you’re preparing for exams (like CMA, CPA, or ACCA) or working in an MNC, journal entry accuracy is a must. I’ve seen professionals lose credibility because they messed up debits and credits, simply because they didn’t understand account types properly.

By mastering Personal, Real, and Nominal accounts, you:

Build a strong foundation.

Gain confidence in interviews.

Reduce mistakes in daily accounting.

Prepare yourself for advanced topics like IFRS, GAAP, or consolidation.

📘 The Mistake My Colleague Was Making

When I worked with a diamond trading company in Dubai, one of our junior accountants kept recording “owner withdrawals” under “Salary Expense.” On paper, it looked like the company was overpaying salaries.

When I reviewed, I explained: This is not a salary (nominal). It’s drawings (personal). Once we reclassified, profits immediately looked more accurate.

This small correction came only from understanding the type of account. I explained this to my colleague, and he got clarity. He practised it several times and never made this mistake again.

📊 Quick Recap – Types of Accounts

So far we have learned the three types of accounts, which can make us confident in Accounting, these accounts and there rules are;

Personal Account – Debit the receiver, Credit the giver.

Real Account – Debit what comes in, Credit what goes out.

Nominal Account – Debit expenses/losses, Credit incomes/gains.

Mastering account types = mastering journal entries.

🤝 My Final Thoughts

Accounting may look complex, but once you break it down, it becomes easy. The Types of Accounts are like the ABCs of accounting. If you know them, you can construct any financial “sentence.”

At The Accountant Hub, we’re on a mission to help accountants and finance professionals build clarity and confidence, one concept at a time.

If you’re serious about strengthening your foundation and growing your career with structured learning, I invite you to join our VIP group today - Here’s the link:

Let’s master these basics together and step confidently into advanced accounting.

Keep Learning, Keep Growing

Divyesh Dave