The Three Golden Rules of Accounting Explained

learn how the Golden Rules make journal entries simple and logical

When I first started learning accounting, the biggest headache for me was “What to Debit? What to Credit ?”

I would sit with journal entries and wonder endlessly, why do we debit expenses but credit incomes? Why does cash go on one side and sales on the other?

One day, my mentor explained it to me very simply:

👉 “If you understand the 3 Golden Rules of Accounting, debit and credit will never confuse you again.”

That sentence stuck with me. And after practicing these rules in hundreds of transactions, I can confidently say: mastering these rules is the single biggest key to becoming confident in accounting.

Today, I’ll explain these rules in a simple way, with examples, mistakes professionals make, and even a story from my own work.

What are the 3 Golden Rules of Accounting?

Accounting works on the double-entry system, for every transaction, there’s a debit and a credit. But how do you know which account to debit and which to credit?

That’s where the Golden Rules come in. They are guiding principles that apply depending on the type of account (Personal, Real, Nominal).

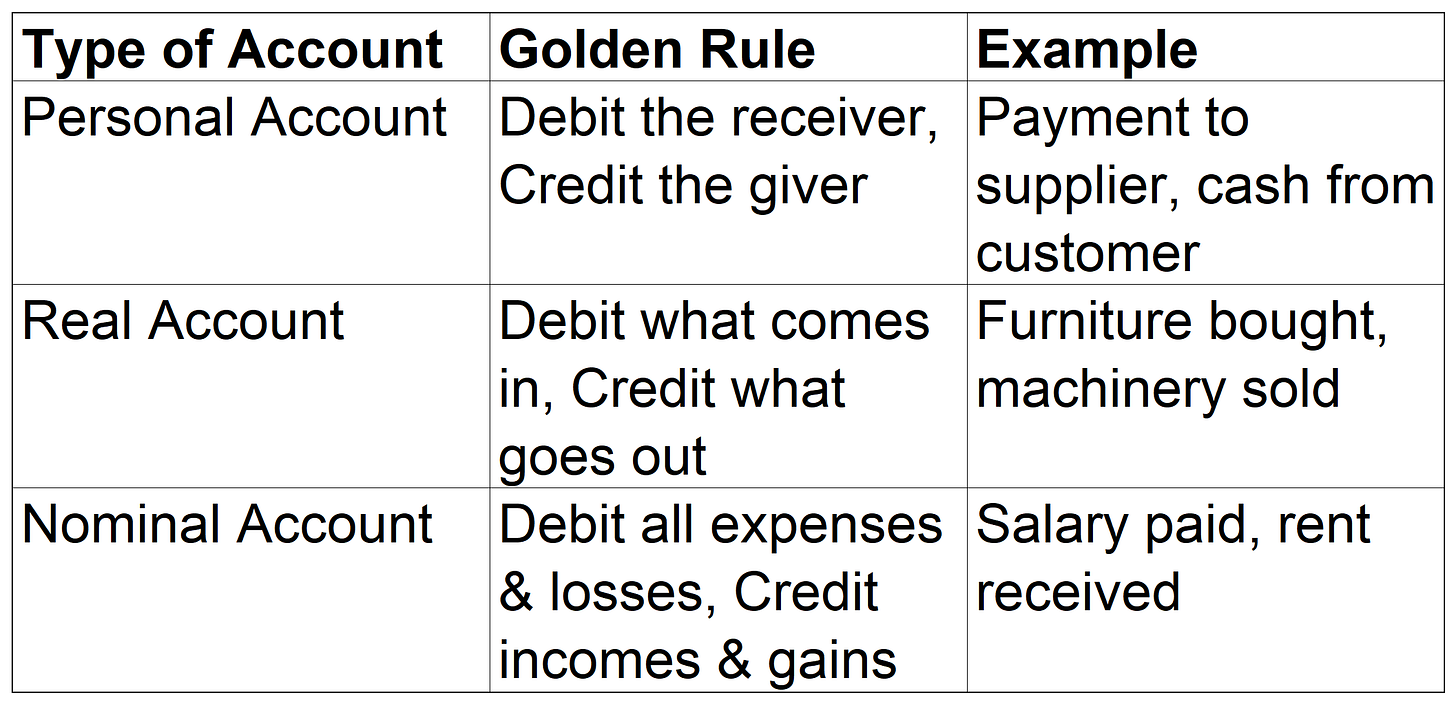

The 3 Golden Rules are based on the type of Account which we learned in the previous blog, like:

Personal Account → Debit the Receiver, Credit the Giver

Real Account → Debit What Comes In, Credit What Goes Out

Nominal Account → Debit All Expenses and Losses, Credit All Incomes and Gains

Let’s break them down one by one.

🧩 1. Rule for Personal Accounts

Rule: Debit the Receiver, Credit the Giver

Personal accounts represent people, organizations, or firms with whom the business has dealings. When value goes into the business (received), we debit that person’s account. When value goes out (given), we credit them.

👉 Think of it as a simple give-and-take relationship.

Examples:

Paying ₹10,000 to Supplier (supplier is giver):

Supplier A/c Dr 10,000

To Cash A/c 10,000

Receiving ₹25,000 from Customer (customer is receiver):

Cash A/c Dr 25,000

To Customer A/c 25,000

🧩 2. Rule for Real Accounts

Rule: Debit What Comes In, Credit What Goes Out

Real accounts relate to assets — both tangible (like machinery) and intangible (like goodwill). When assets come into the business, we debit. When they go out, we credit.

👉 Think of it like your home: when new furniture enters your house, you add it (debit). If you sell or throw it out, you reduce it (credit).

Examples:

Buying office furniture for ₹20,000:

Furniture A/c Dr 20,000

To Cash A/c 20,000

Selling machinery for ₹50,000:

Cash A/c Dr 50,000

To Machinery A/c 50,000

🧩 3. Rule for Nominal Accounts

Rule: Debit All Expenses and Losses, Credit All Incomes and Gains

Nominal accounts relate to expenses, losses, incomes, and gains. This is where we track the company’s performance. Expenses reduce profits, so they are debited. Incomes increase profits, so they are credited.

👉 Think of it like your personal budget: money spent on rent or food is an expense (debit), while your salary or interest earned is income (credit).

Examples:

Paying salary of ₹15,000:

Salary Expense A/c Dr 15,000

To Cash A/c 15,000

Receiving interest ₹5,000:

Cash A/c Dr 5,000

To Interest Income A/c 5,000

A Quick Summary Table

Applying All Three Rules in One Transaction

Let’s say there is an Entrepreneur, Tim, who owns a Car Cleaning business called “Speedo Car Cleaning”, and receives ₹50,000 cash from a customer for car cleaning services. So this is a financial transaction, and here are the parts of this transaction:

Customer (Personal Account) – Debit the receiver

Cash (Real Account) – Debit what comes in

Service Income (Nominal Account) – Credit income

👉 So here we pass the Journal Entry:

Cash A/c Dr 50,000 (Real – comes in)

To Service Income A/c 50,000 (Nominal – income earned)

Notice how all 3 rules are applied automatically once you know the type of account.

Common Mistakes To Avoid

Even experienced professionals sometimes struggle with applying these rules correctly. Here are the four most common errors you should avoid:

Recording Drawings as Expenses

Many accountants mistakenly record the owner’s personal withdrawals (drawings) as business expenses. In reality, drawings are a personal account transaction, not a nominal one.Ignoring Intangible Assets

Often, only physical assets are recorded, while intangibles like goodwill, patents, or software licenses are forgotten. These fall under real accounts and must be included.Treating Advances as Income

Advance payments from customers are often wrongly credited to income. In reality, until goods/services are delivered, they are a liability (advance received).Not Closing Nominal Accounts

Nominal accounts (incomes & expenses) must be closed at year-end into the Profit & Loss account. Forgetting this distorts the next year’s results.

Why Mastering These Rules is a Career-Changer

When you truly master the Golden Rules:

Journal entries become second nature.

You’ll make fewer mistakes in reconciliations.

Your confidence grows in interviews and exams (CMA, CPA, ACCA).

You prepare yourself for advanced accounting concepts like IFRS, GAAP, and consolidation.

I’ve personally seen professionals lose credibility because they couldn’t explain simple debits and credits during an audit. On the other hand, I’ve also seen careers skyrocket because someone had a strong grip on these fundamentals. So, the foundation is the key, and these rules can help you to make the foundation strong in your Accounting profile.

I remember in my team, my junior accountant sometimes kept recording advance payments from customers as income. On paper, it looked like the company had higher revenue. But when the audit came in, auditors flagged it as a mistake to avoid..

When I sat with him and explained the Golden Rules in the context of advance payments:

The money came into the business (Cash – Real Account → Debit).

But it wasn’t yet income (Nominal Account).

It was a liability towards the customer (Personal Account → Credit).

Once he saw the classification this way, it clicked. He never made the mistake again.

Here’s a Quick Recap of The 3 Golden Rules

Personal Account → Debit the receiver, Credit the giver.

Real Account → Debit what comes in, Credit what goes out.

Nominal Account → Debit expenses/losses, Credit incomes/gains.

Mastering these = confidence in journal entries.

And it is fine, sometimes, Accounting may look complicated, but when you master the Golden Rules, and other foundational principles, everything becomes easier. They are the grammar rules of the accounting language; if you get them right, you can “speak” accounting language fluently.

At The Accountant Hub, we focus on building clarity and confidence by learning foundational concepts step by step. These basics may look small, but they’re the foundation for everything advanced you’ll ever do.

👉 If you want to grow your accounting career with structured learning and a supportive community, I invite you to join our VIP group today. Here’s the link

Let’s not just learn the rules - let’s apply them with confidence.

With clarity,

Divyesh Dave

The Accountant Hub