The Accounting Cycle Explained: Step by Step

Understand how every transaction flows from invoice to balance sheet

How Every Transaction Flows from a Single Invoice to the Final Financial Statements

When I was new in accounting, I could record journal entries - debit this, credit that - but I had no clue how those entries finally became a Balance Sheet or Profit & Loss statement.

I remember sitting in my first audit and seeing my senior flip through ledgers, trial balances, and adjustments as if he were solving a puzzle. I was lost.

One day he smiled and said,

👉 “Divyesh, accounting is a cycle. Once you understand the flow, from source document to statement, you’ll never be confused again.”

That line stayed with me.

Today, I want to explain the same Accounting Cycle in a simple and practical way - the same way I learned it, so you can see the complete picture of how transactions move through your books and form the story behind every financial statement.

So What Is the Accounting Cycle?

The Accounting Cycle is the step-by-step process accountants follow to record, classify, summarize, and report financial transactions of a business.

Think of it like a full-year journey of your financial data, starting when a transaction happens and ending when financial statements are prepared for decision-making.

👉 In simple terms:

Every business transaction passes through a series of stages. Like,

Source Document → Journal → Ledger → Trial Balance → Adjustments → Financial Statements.

It’s called a cycle because the process repeats every accounting period (monthly, quarterly, yearly).

Why do we need the Accounting Cycle?

You might wonder, “Why do I need to remember these steps? I can just record entries in software like Tally, QuickBooks, or Zoho.”

Here’s why this cycle still matters, even in 2025:

It builds clarity – You understand how every number connects.

It ensures accuracy – You can spot and fix errors early.

It helps in audits – You can explain the flow confidently to auditors.

It improves decision-making – You know where your financial data stands.

It separates bookkeepers from accountants – Bookkeepers record; accountants interpret.

Understanding this cycle makes you a professional who sees the big picture, not just a data entry operator.

The 9 Steps of the Accounting Cycle

Let’s break it down, one stage at a time, using the story of Tim, our friend who runs Speedo Car Cleaning Services. Are you ready? Let’s go through this.

🧾 Step 1: Identify and Analyze Business Transactions

Every cycle starts with a real-life transaction, a financial event that affects the business.

For example:

Tim buys cleaning materials worth ₹10,000 from a supplier.

He pays salaries of ₹15,000.

He earns ₹30,000 for cleaning 20 cars.

Each of these has a source document, invoice, payment voucher, receipt, or bank statement as proof.

👉 Golden rule is: No entry without evidence.

Here are a few Examples of Source Documents:

Sales invoices

Purchase bills

Bank statements

Salary sheets

Utility bills

Tim collects all these documents daily. This is where accounting begins, because we need some documents to find the financial transactions that actually happen. Right?

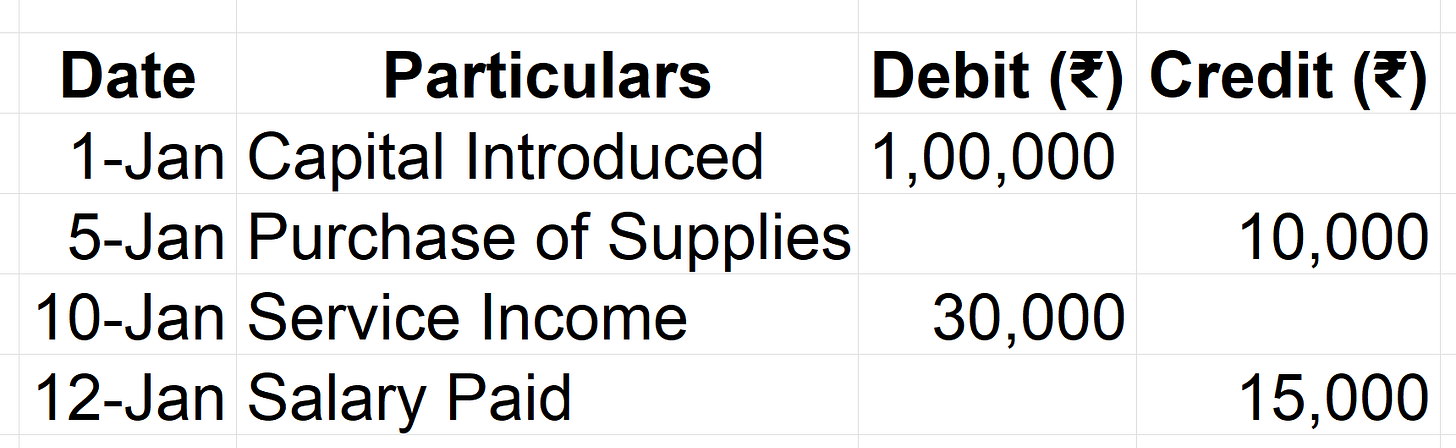

Step 2: Journalize the Transactions

Once identified, each transaction is recorded in the Journal, also known as the Book for Journal Entries.

Here, we apply the three golden rules and record transactions in the debit-credit format with a short narration.

Example:

Tim buys cleaning material for ₹10,000 in cash.

Cleaning Supplies A/c ........ Dr ₹10,000

To Cash A/c ................................ ₹10,000

(Being cleaning material purchased for business use)This journal entry shows both sides, where the money went and where it came from.

👉 The Purpose is: To maintain a chronological record of all business events.

Step 3: Post Entries into the Ledger

Next comes the Ledger, also called the Book of Final Entry.

The ledger groups similar transactions under individual account heads, like Cash, Purchases, Sales, Salary, Equipment, etc.

So all cash transactions go to the Cash Account, all salary transactions to the Salary Expense Account, and so on.

Think of the ledger as the heart of the accounting system.

Example:

All of Tim’s cash inflows and outflows are posted to the Cash Ledger:

👉 Ledger shows balance: how much cash Tim has left.

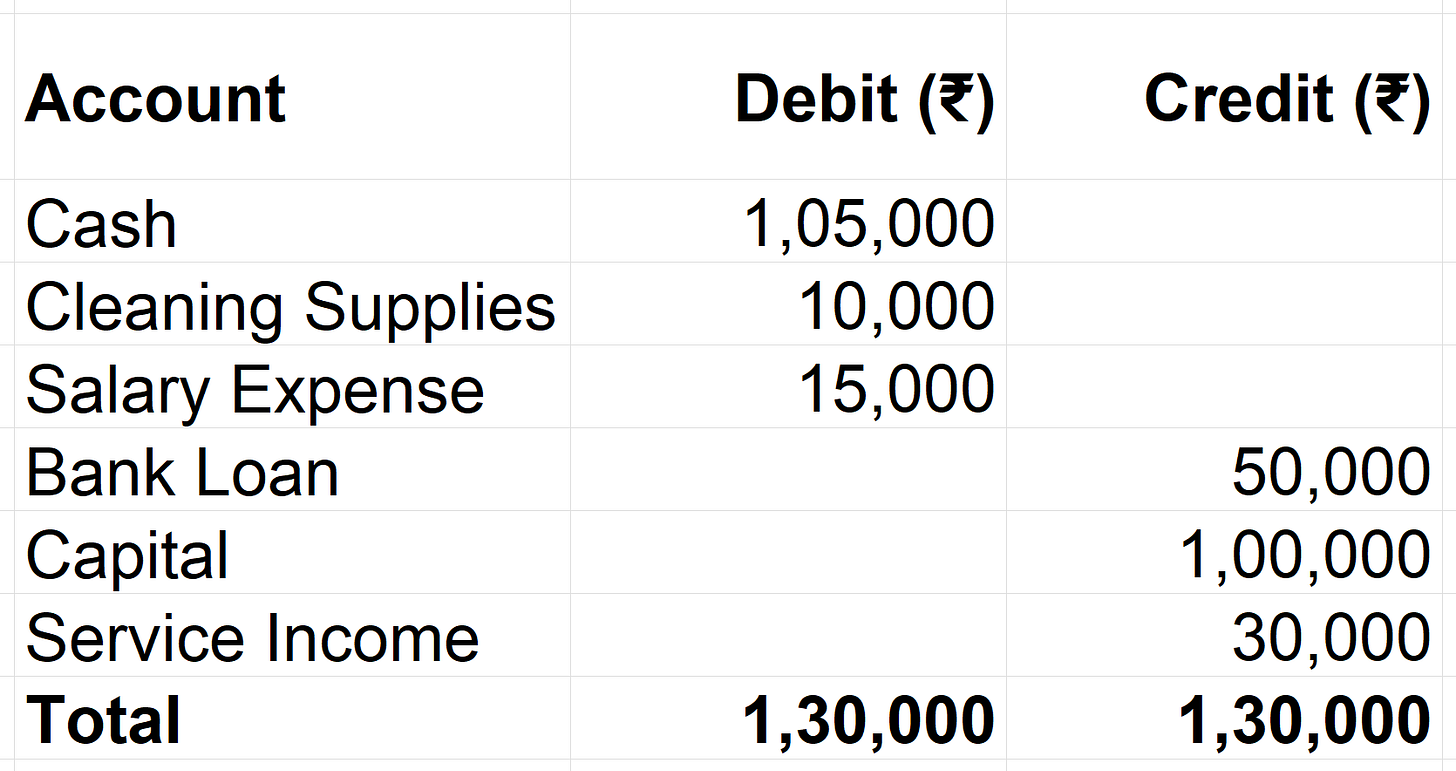

Step 4: Prepare the Trial Balance

Once all transactions are posted, it’s time to test mathematical accuracy.

A Trial Balance lists all account balances, both debit and credit, to ensure that the accounting equation still holds true.

👉 Assets = Liabilities + Equity.

(Check this blog if you wish to learn about the accounting equation in Detail: Accounting Equation )

Example of Tim’s Trial Balance:

If both sides match, perfect!

If not, there’s an error to be found before moving ahead.

👉 Purpose: Verify that total debits = total credits.

Step 5: Make Adjusting Entries

Before preparing financial statements, some transactions must be adjusted to reflect accurate figures for the period.

Adjusting entries ensure revenues and expenses are recorded in the correct period — following the accrual basis and matching principle.

Common adjustments include:

Accrued income

Outstanding expenses

Prepaid expenses

Depreciation

Example:

Tim prepaid rent of ₹12,000 for 6 months. At month-end, only ₹2,000 applies to the current month.

Adjustment entry:

Rent Expense A/c ........ Dr ₹2,000

Prepaid Rent A/c .......... Dr ₹10,000

To Cash A/c ............................. ₹12,000 This ensures only the correct portion of rent appears as an expense for the period.

Step 6: Prepare the Adjusted Trial Balance

After adjustments, a new Adjusted Trial Balance is prepared.

This becomes the final working document for preparing the financial statements.

It reflects all updated balances, ensuring that revenues and expenses are recognized correctly.

Step 7: Prepare Financial Statements

Now comes the part every business owner and accountant looks forward to, the Financial Statements.

These include:

Income Statement (Profit & Loss Account)

Shows performance, revenue, expenses, profit or loss.

Example: Tim’s service income ₹30,000 – expenses ₹15,000 = profit ₹15,000.Balance Sheet

Shows financial position, what Tim owns (assets), owes (liabilities), and what’s left for him (equity).

Example:

Assets ₹1,65,000 = Liabilities ₹50,000 + Equity ₹1,15,000Cash Flow Statement (optional at small business level)

Shows inflows and outflows of cash from operations, investments, and financing.

👉 These statements together tell the full financial story.

Step 8: Closing the Books

At the end of the accounting period, temporary accounts like revenues and expenses must be closed to determine net profit or loss.

This profit or loss is then transferred to the Capital or Retained Earnings Account.

Example:

Service Income A/c ......... Dr ₹30,000

To Profit & Loss A/c ................... ₹30,000

Profit & Loss A/c ............ Dr ₹15,000

To Salary Expense A/c ............. ₹15,000 If revenue exceeds expenses, the balance goes to Capital (Equity) as profit.

This resets revenue and expense accounts to zero for the next cycle.

Step 9: Post-Closing Trial Balance and Reversal Entries

Once the books are closed, a Post-Closing Trial Balance ensures that only permanent accounts (Assets, Liabilities, Equity) remain open.

In the new accounting period, certain entries from the previous period (like accrued expenses) may be reversed to simplify record-keeping.

👉 The cycle starts again, fresh books, same process.

Tim’s Journey – Accounting Cycle in Action

Let’s quickly walk through Tim’s Speedo Car Cleaning example from start to finish:

Transaction happens: Tim buys cleaning supplies worth ₹10,000.

Source document: Supplier invoice received.

Journal entry: Supplies/Exp. Dr ₹10,000 / To Cash ₹10,000.

Ledger posting: Supplies and Cash accounts updated.

Trial balance: Debits = Credits = ₹1,30,000.

Adjustment: Rent prepaid adjusted for 1 month.

Adjusted Trial Balance: Updated balances reflected.

Financial statements prepared: Profit ₹15,000, Assets ₹1,65,000.

Books closed: Profit transferred to capital; next month starts anew.

This continuous loop ensures accuracy, transparency, and accountability in every accounting system.

Common Mistakes in the Accounting Cycle

Even experienced accountants sometimes stumble. Here are a few errors I’ve personally seen (and corrected).

1. Skipping Source Documents

Recording entries without invoices or receipts leads to incomplete audits. Always attach proof.

2. Ignoring Adjustments

Unrecorded accrued expenses or prepaid income distort profits. Adjustments make statements real.

3. Mixing Cash and Accrual Basis

Recording transactions only when cash moves violates accrual principles and misstates performance.

4. Forgetting to Close Nominal Accounts

Leaving old revenue or expense balances open affects next period’s profit.

5. Copy-Pasting Trial Balances from Software

Many rely blindly on software-generated reports without cross-checking ledger postings. Manual review is still essential.

Best Practices to Master the Accounting Cycle

Follow the flow visually – Create a chart from source documents to statements.

Keep documentation organized – Label invoices and vouchers clearly.

Review trial balance monthly – Don’t wait till year-end to detect errors.

Reconcile bank accounts regularly – Prevents surprises during audits.

Understand the “why,” not just the “how.” – Know the logic behind every adjustment.

Use accounting software smartly – Automation is great, but human review is priceless.

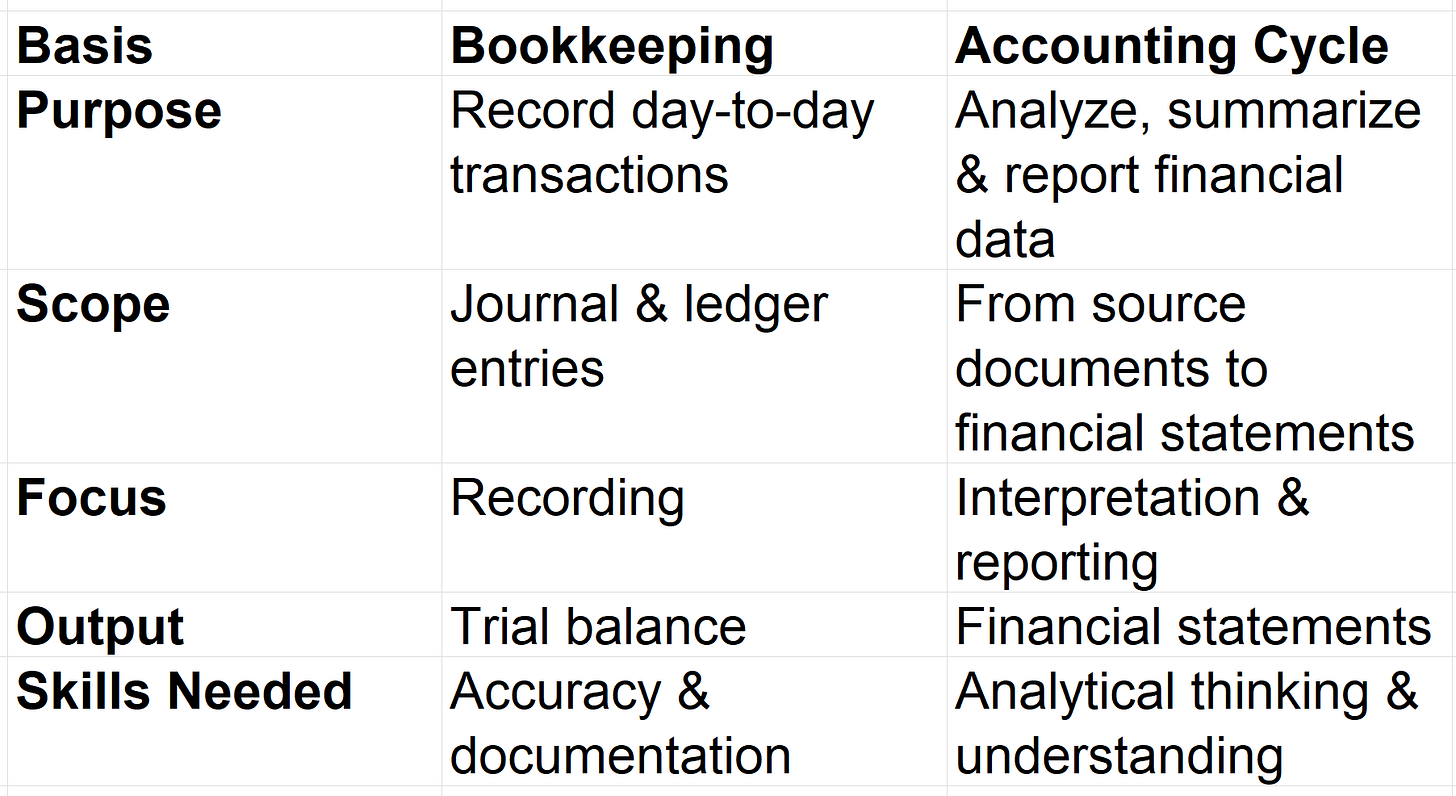

Difference Between Bookkeeping and the Accounting Cycle

Bookkeeping is just the beginning; Accounting completes the story.

Quick Recap

Let’s summarise everything in one simple flow chart:

👉 Source Document → Journal → Ledger → Trial Balance → Adjustments → Financial Statements → Closing → Reversal → New Period.

Each step builds upon the last, forming a full-circle process that keeps the books balanced and the business transparent.

Remember:

Every entry starts with evidence.

Every figure ends in a statement.

And every cycle builds trust.

Question Time for you.

If this concept is clear to you, check these questions to test your understanding.

Which part of the accounting cycle do you find most confusing, journalizing, adjustments, or closing?

How do you ensure accuracy in your trial balance every month?

Drop your thoughts in the comments. I would love to read everyone.

🤝 Final Thoughts

The accounting cycle is more than a technical process; it’s the rhythm of every business.

Once you understand it, you’ll never see accounting as just numbers.

You’ll see stories of effort, investment, growth, and outcomes.

If you’re a student, mastering this cycle will make advanced topics like IFRS, consolidation, and analysis effortless.

If you’re already working, it will sharpen your accuracy and boost your audit confidence.

At The Accountant Hub, my mission is to help accountants like you build clarity, confidence, and high-income skills of Accounting and Finance step by step.

👉 If you’re serious about mastering accounting concepts and growing in your career,

Join our VIP community today. » Here’s the link The Accountant Hub.

Let’s learn, grow, and create confident accountants together.

Keep Learning, Keep Growing

Divyesh Dave

The Accountant Hub