How To Use SUMIF vs SUMIFS in Excel

The Quick guide to replace SUMIFS with SUMIF in Excel for Accountants - Divyesh Dave

If you work in accounting or finance, you already know how much time is spent analyzing numbers like revenue, expenses, salaries, or cash flows. But sometimes, traditional formulas like =SUM(A1:A100) just don’t cut it.

That’s where SUMIF and SUMIFS come in, two of Excel’s most powerful functions for accountants. They let you sum data based on specific conditions, which means you can build reports, analyze ledgers, or prepare management summaries in minutes instead of hours.

In this post, I, will guide you through the difference between SUMIF and SUMIFS, when to use each, and how SUMIFS can transform your daily accounting and financial analysis tasks.

By the end of this post, you’ll not only understand these formulas but also see how to apply them to real accounting problems like sales reports, expense tracking, and budget variance analysis. Let’s start with basic.

What Are SUMIF and SUMIFS?

Let’s break this down simply.

SUMIF → “Sum if one condition is true.”

SUMIFS → “Sum if multiple conditions are true.”

Here, the logic is easy:

SUMIF = One filter

SUMIFS = Multiple filters

USING SUMIF - When You Need a Single Condition

Syntax:

=SUMIF(range, criteria, sum_range)How does it work in Excel: -

Basically, Excel checks each cell in the range. If it meets the criteria, the corresponding value in sum_range is added.

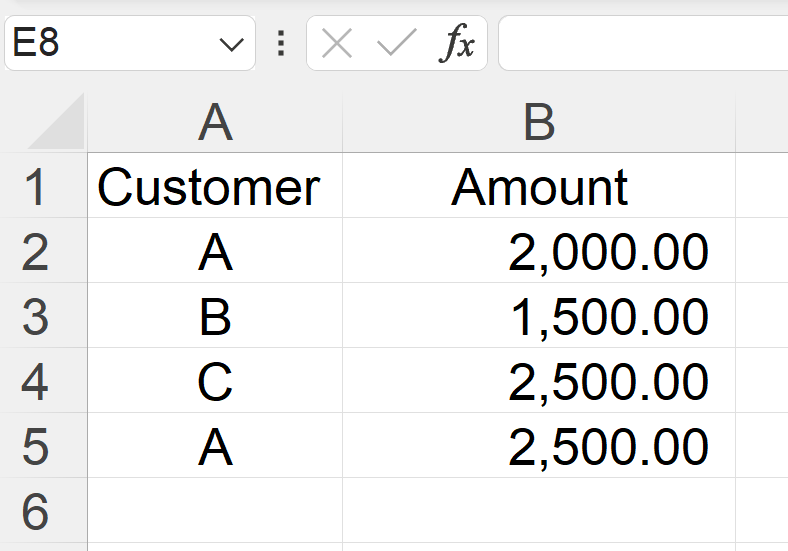

Example - Summing Sales by Customer

For Example, you have the following sales list:

The Formula for Sumif (Single Criteria) Will be:

=SUMIF(A1:A5, “A”, B1:B5)✅ Result = 2000 + 2500 = 4500

Accounting Use Case:

Use SUMIF when you need to total transactions for one customer, vendor, or account in your trial balance or ledger.

USING SUMIFS - When You Need Multiple Conditions

Now let’s step up to the real power tool.

Syntax:

=SUMIFS(sum_range, criteria_range1, criteria1, [criteria_range2, criteria2], …)This formula checks multiple conditions before adding values.

Example - Summing Expenses by Department and Month

Let’s say your expense sheet looks like this:

Formula to find Admin expenses for Jan:

=SUMIFS(C2:C5, A2:A5, “Admin”, B2:B5, “Jan”)✅ Result = 1200

Explanation:

Excel adds values from column C only if:

Department = Admin

Month = Jan

Accounting Use Case:

Use SUMIFS when you want to filter transactions by multiple categories — like department, month, region, or type of expense.

Example - Total Sales for a Product in a Specific Region

Formula, you will use is:

=SUMIFS(C2:C4, A2:A4, “Diamond”, B2:B4, “UAE”)✅ Result = 5000

In accounting, this could be:

Total Revenue for a specific Product Category in a specific Location.

Total Expenses for a specific Cost Center in a specific Month.

I mean, there are so many combinations you can use as per requirement of the Report.

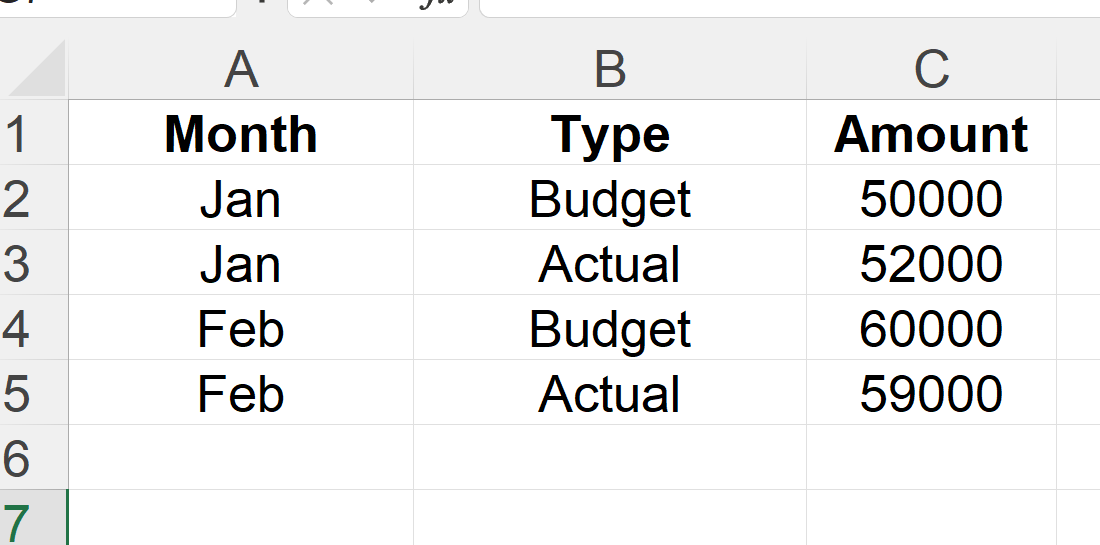

Example - Variance Analysis Using SUMIFS

Imagine you have your Budget and Actual data in one table:

Formula for total Budget:

=SUMIFS(C2:C5, B2:B5, “Budget”)Formula for total Actual:

=SUMIFS(C2:C5, B2:B5, “Actual”)Then variance = Actual – Budget, simple linking.

👉 Does it look Easy, quick, and error-free reporting? These are the fundamentals. By learning and mastering this, you can actually build bigger reports with huge data as well and save your time.

I hope you are able to see the difference in using SUMIF and SUMIFS. SUMIFS is way more powerful than SUMIFS. You won’t believe that most of my management dashboard and reports automation I do with SUMIFS without any VBA Code.

Few Real Accounting Scenarios: -

Here I have added few real accounting scenerios, where if you use SUMIFS, it Can saves a lot of time in a day. Like;

Trial Balance Automation:

Sum values from journal entries by account type.

Example: Total revenue by “Account Code”.Departmental Expense Analysis:

Use criteria for both “Department” and “Month”.Revenue by Region and Product:

Great for management reporting.Budget vs Actual Comparison:

Separate data types (“Budget”, “Actual”) and sum accordingly.Aging Analysis:

Combine date conditions to sum invoices between time periods.

SUMIFS with Dynamic Criteria

When your criteria change regularly, make them cell-based.

For example, if cell E1 has “Admin” and E2 has “Jan”:

=SUMIFS(C2:C10, A2:A10, E1, B2:B10, E2)This makes your formula dynamic and easy to update without editing formulas manually.

SUMIFS vs SUMIF – Key Differences

Here I have mentioned few key differences of SUMIF vs SUMIFS: -

✅ A Quick Tip For You:

I am sure, once you start using SUMIFS, you will stop using SUMIF, even if you have a single criterion. So, always use SUMIFS for flexibility, even when one condition is needed - it future-proofs your file.

Common Mistakes To Avoid and Best Practices

Common Mistakes:

Mixing up the range order. (In SUMIFS, sum_range comes first.)

Using inconsistent column ranges (must be same length).

Forgetting quotation marks around text criteria.

Using wrong date format — Excel reads

“>1-Jan”correctly, not>1/1/25.

Best Practices you can follow:

Use absolute cell references (

$) when copying formulas.Keep data clean (no hidden spaces in text).

Combine SUMIFS with cell references for flexibility.

Test results with small datasets first.

Case Study – Monthly P&L Automation

A Dubai-based trading firm uses one Excel sheet with all entries from Tally ERP.

Columns include:

Date

Account Name

Category (Revenue, Expense, etc.)

Amount

They used to manually filter and sum each category. Now with SUMIFS, they built automatic totals for:

Revenue:

=SUMIFS(D2:D10000, C2:C10000, “Revenue”)Expenses:

=SUMIFS(D2:D10000, C2:C10000, “Expense”)

Then they linked totals to a clean dashboard using simple references.

What used to take 4 hours now takes 15 minutes.

Future of Excel Analysis: SUMIFS + AI

Excel is evolving with AI-powered Copilot. You’ll soon be able to type:

“Sum total sales for Admin department in Q1”

And Excel will build your SUMIFS formula automatically.

Still, understanding SUMIFS manually ensures you can audit, explain, and control results — skills every finance professional must have.

So here’s my take,

For accountants and finance professionals, SUMIF and SUMIFS are not just formulas - they’re automation tools. They save time, improve accuracy, and bring clarity to financial data.

Whenever you prepare budgets, ledgers, or reconciliations, think SUMIFS. It’s the powerful friend of clean and robust reporting.

SUMIF = Simple condition.

SUMIFS = Powerful multi-condition analysis.

Master them both, and you’ll work faster, smarter, and more confidently.

So Tell Me,

Which of these SUMIFS examples will you apply first in your daily accounting work?

Please share your thoughts in the comments below.

If you enjoyed this guide, join The Accountant Hub community - where I will share a practical Excel 30 Days playlist created for you to help you become a confident in Excel.

Join my Elite Community of Confident Accountants Here": -

I will see you in next blog.

Have a great learning.

Divyesh Dave