Components of Financial Statements Explained

Understand how all the Financial Statement Components connects to form a complete business story - By Divyesh Dave

I still remember my first experience with Financial Statements. When I joined my first office, I had never created financial statements in real life.

In college, only there I learned what a Balance Sheet and Profit & Loss Account are and what it look like, but in practice, it was so much more than that.

Creating a real set of financials gave me a hard time. There were adjustments, reconciliations, rounding issues, and endless cross-checks. And that suspense account, my god, that still makes me laugh, which I used to match my balance sheet, temporarily.

But everything takes time, so did the proper creation of Financial Statement as well for me. And, after several rounds of trial and error, in multiple years, I finally started connecting the dots, how numbers travel from ledgers to financial statements and how those statements tell the story of a business. I found it is not just a Balance Sheet and Profit and Loss Account, well definitely these are the main one, but there are other components as well.

And that’s what I’m about to share with you in this blog, a smaller version of my own learning journey about financial statements and what each component truly means.

What Are Financial Statements?

Financial statements are structured reports that summarize a company’s financial performance and position during a specific period.

They translate thousands of journal entries into a set of clear, understandable numbers that managers, investors, and even regulators can read like a business diary.

Think of them as the final destination of the accounting cycle — where all your hard work of bookkeeping, posting, and adjusting finally becomes meaningful information.

Purpose:

To tell how much the business earned, how efficiently it operated, what it owns, what it owes, and how much value belongs to its owners.

Components of Financial Statements

Under IFRS and most accounting frameworks or Standards, a full set of financial statements includes five parts:

Statement of Financial Position (Balance Sheet)

Statement of Profit or Loss (Income Statement)

Statement of Cash Flows

Statement of Changes in Equity

Notes to Accounts (Explanatory Notes)

These five together give the complete financial story. Let’s understand each of them in depth.

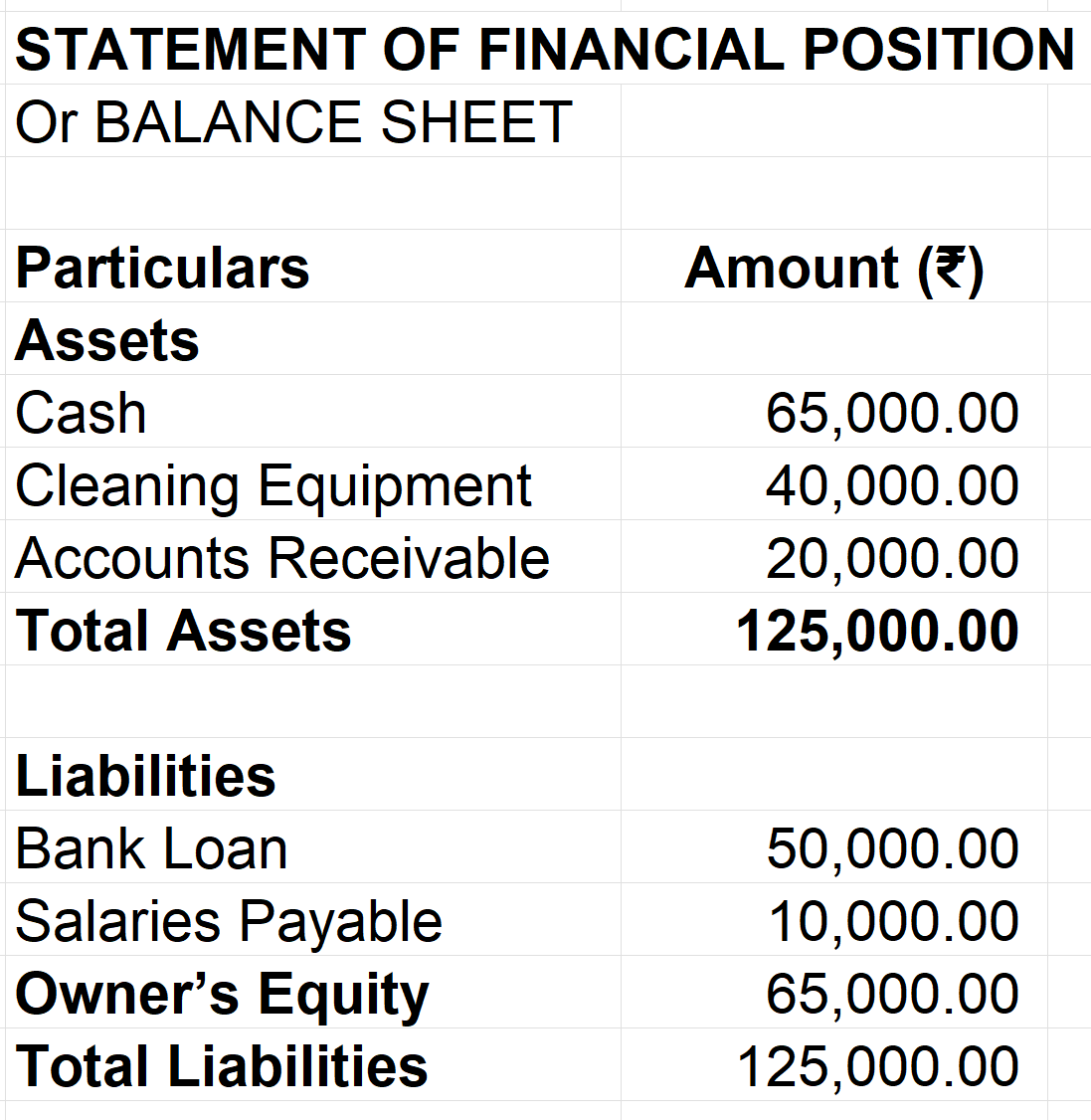

1. Statement of Financial Position (Balance Sheet)

The Balance Sheet is like a photograph, that’s why it is called a SNAPSHOT. It captures the financial position of the business at one moment in time. It shows what the company owns (Assets), owes (Liabilities), and what ultimately belongs to its owners (Equity).

Formula:

Assets = Liabilities + Equity

It’s called a “Balance Sheet” because both sides must always balance; every asset is funded either by borrowed money or by owners’ capital. Pretty Simple, Right?

We will again take the example of our Friend Tim and his Car Cleaning business to understand each component.

SPEEDO CAR CLEANING - I hope you remember him 🙋🏻♂️

📘 Example (Tim’s Balance Sheet)

The balance sheet is the foundation for assessing a company’s strength. When I first prepared mine, it took me days to match the totals — but when it finally balanced, that “click” moment was unforgettable. It wasn’t just a sheet; it was the financial health report of the business.

A healthy balance sheet doesn’t mean just having big assets; it means having the right mix, enough liquidity to meet short-term obligations and strong equity to sustain growth. Accountants and CFOs often use ratios like current ratio, debt-to-equity, and return on assets to interpret it.

When you understand the balance sheet, you can instantly see how money flows inside a business, how much is invested, how much is borrowed, and how much truly belongs to the owner.

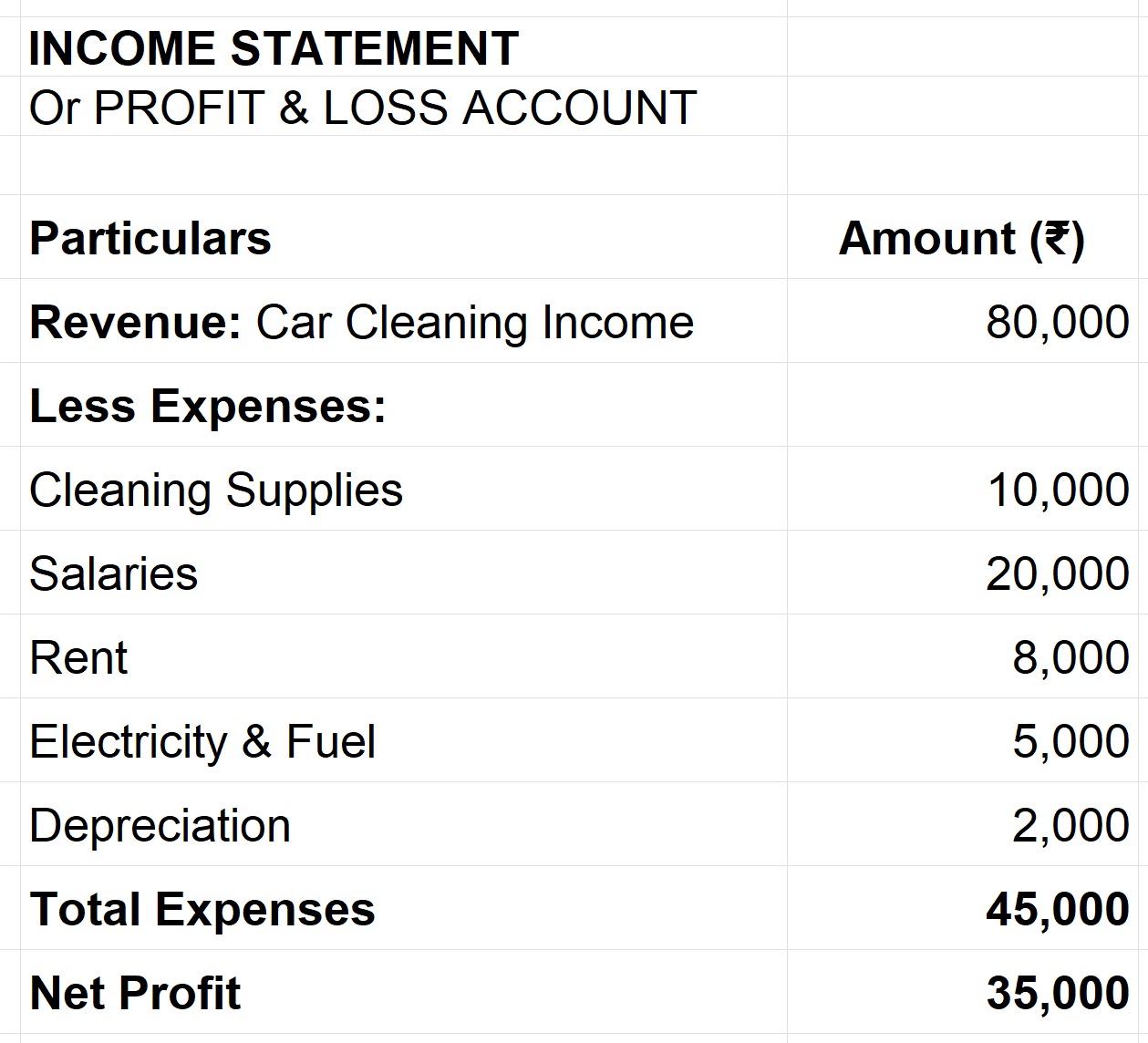

2. Profit & Loss Account (Income Statement)

The Income Statement — or Profit & Loss Account — shows performance over time. It answers the most common question every owner has:

👉 Did we make a profit or a loss this period?

It lists all revenues earned and expenses incurred to arrive at the net profit.

Example (Tim’s Monthly P&L)

When I prepared my first income statement, I thought it was simply about “revenues minus expenses.” But soon I realized, it’s more about stories behind numbers, how efficiently the business converted sales into profit, where costs were leaking, and which months performed better.

A P&L also helps management plan better. For example, by analyzing the trends of Tim’s cleaning business, we might notice that salaries form 45% of total expenses, a sign that automation or better scheduling could improve margins. Over time, an accountant doesn’t just prepare this statement, they use it as a tool to improve performance.

The profit or loss at the end of this statement becomes the bridge to the Statement of Changes in Equity and eventually impacts the Balance Sheet.

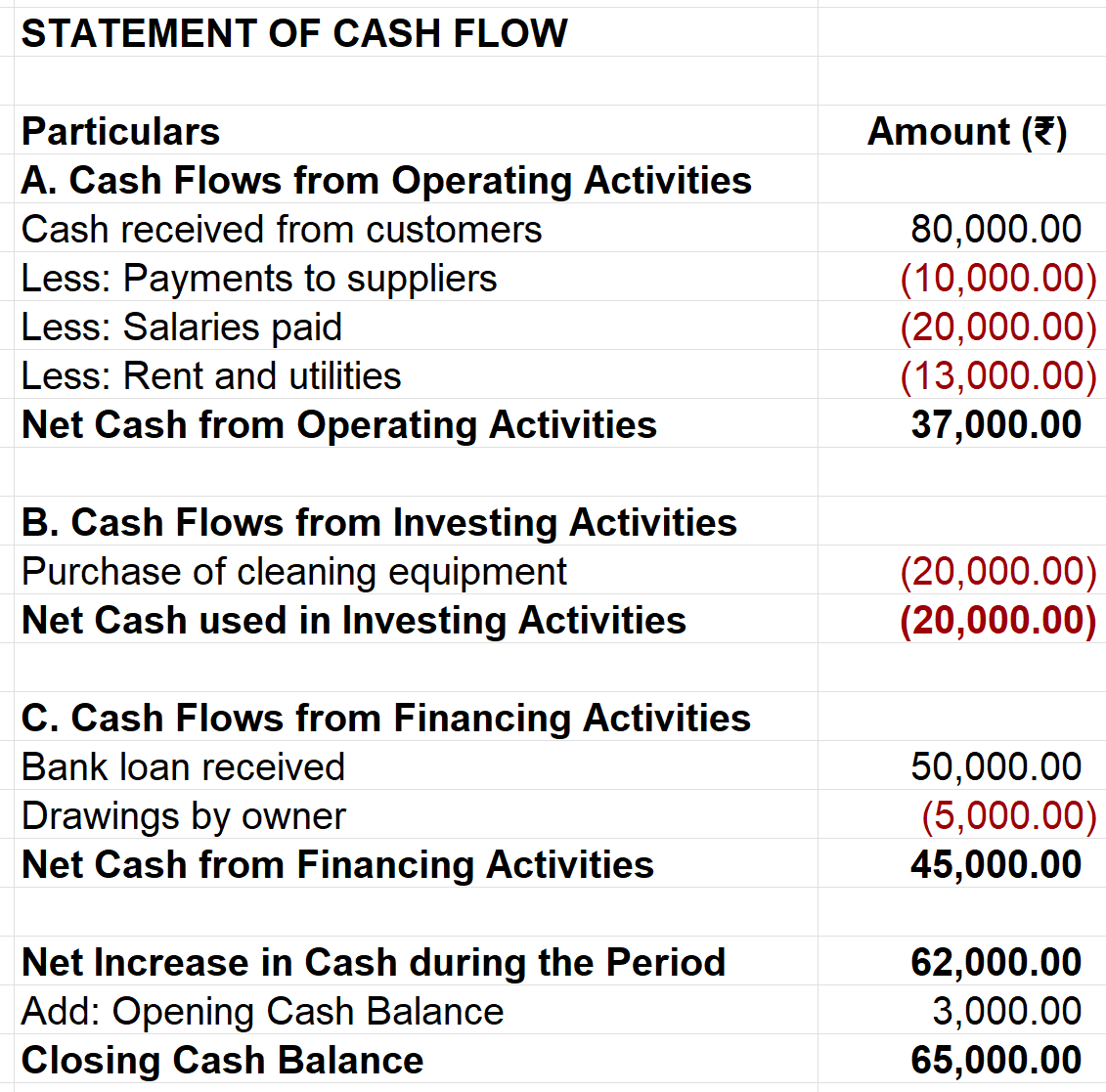

3. Statement of Cash Flows

The Cash Flow Statement tells the truth behind profits. You can show profit on paper, but without cash in hand, a business cannot survive.

This statement explains how cash moved during a period — where it came from and where it went.

Cash flows are divided into three activities:

Operating Activities – day-to-day operations (revenue collection, supplier payments, salaries)

Investing Activities – buying or selling long-term assets (equipment, property, etc.)

Financing Activities – money from or to owners and lenders (loans, capital, dividends)

Example (Tim’s Cash Flow Summary)

Many accountants underestimate how powerful this statement is. I learned that a company can show profit yet face a cash crisis if customers delay payments. The cash flow statement exposes those timing differences between accrual-based profits and real cash movement.

It also helps management forecast liquidity needs. If operating cash flow is consistently positive, the business is sustainable. If not, it signals the need to review pricing, collection, or expense policies.

In short, this statement keeps you grounded in reality, because, at the end of the day, bills are paid in cash, not profit.

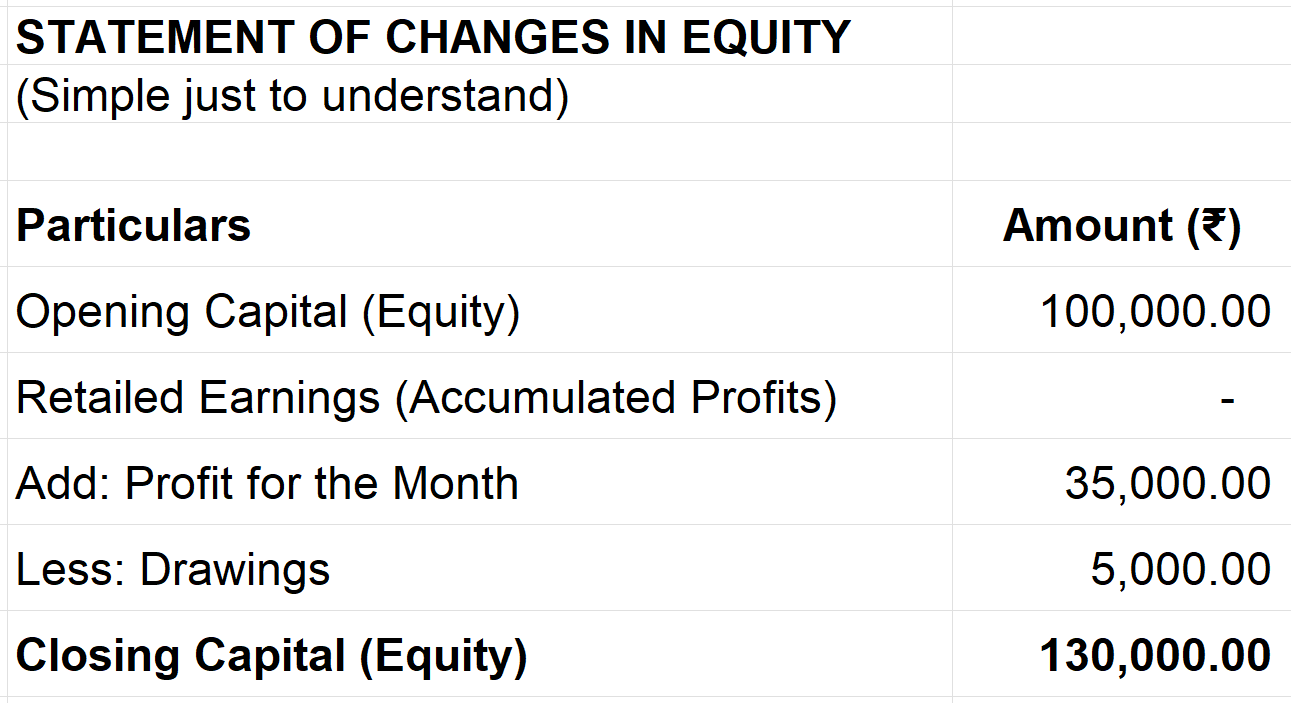

4. Statement of Changes in Equity

The Statement of Changes in Equity explains how the owner’s stake in the business changes during a period. It links the Income Statement and the Balance Sheet, showing how profit, drawings, and new capital impact equity.

Example (Tim’s Equity Statement)

When I first saw this special report, I wondered, “Why do we need this if we already have profit shown in P&L?” “Is this really necessary?”

But I soon realized that equity is more than just profit, it’s about analyzing ownership growth.

This statement shows how much of the earnings are retained versus withdrawn. For investors, it signals the company’s reinvestment behavior. For owners, it reveals how much of their capital is growing through performance.

Over time, strong retained earnings indicate a financially stable and expanding business, something every CFO tracks closely.

5. Notes to Accounts (Explanatory Notes)

Numbers alone are never enough. The Notes to Accounts tell the story behind the numbers.

They include accounting policies, valuation methods, assumptions, breakdowns of major figures, and additional disclosures required by standards.

Example (Tim’s Notes)

“Cleaning equipment is depreciated using the straight-line method at 20% per annum. Prepaid rent of ₹10,000 is recognized as an asset and expensed monthly.”

I remember once preparing financials where our auditor asked for depreciation policy disclosure. I hadn’t included it — because I thought it was obvious. That’s when I realized: transparency isn’t optional; it’s a professional responsibility.

Notes to accounts build trust. They help stakeholders understand how results were achieved, not just what the results are. They turn financial data into meaningful, reliable information.

How These Components Work Together

Each statement is like a chapter in the same book:

The Income Statement tells how the business performed.

The Balance Sheet shows its health at period-end.

The Cash Flow Statement reveals actual liquidity.

The Equity Statement explains changes in ownership value.

The Notes provide the reasoning and transparency behind it all.

Together, they make the financial story complete and credible.

Few Smart Practices for Building Reliable Financial Statements

Start with verified data.

Ensure the trial balance is accurate and reconciled before drafting statements.Maintain consistency in accounting policies.

Changing depreciation or valuation methods every year creates confusion.Document every adjustment clearly.

Whether it’s accrued income or prepaid rent, note why and how it was made.Link across statements.

Check that net profit in the P&L equals the increase in equity and reflects correctly in retained earnings.Focus on presentation and clarity.

Well-structured statements with proper headings, totals, and notes speak volumes about professionalism.

These practices don’t just create compliance, they build credibility. As accountants, our work reflects the truth of a business, and that truth must be clean, clear, and consistent.

Why Financial Statements Are Important?

Financial statements are more than documents, they’re communication tools.

When you understand them, you can read the story of any company without meeting the owner or visiting the office.

You’ll see where the business stands, how efficiently it operates, and what its future might look like.

For accountants, mastering these components means gaining the ability to translate numbers into insight. Whether you’re preparing for CMA/CPA/CA or working in an audit firm or advising clients, this knowledge turns you from a record-keeper into a decision-maker.

That’s what separates average accountants from confident professionals who lead conversations in boardrooms.

Here’s a Quick Question for You

On a scale of 1 to 10, how would you rate your financial statement creation skills today? (1 = beginner, 10 = I can confidently prepare complete financials) Consider speed, accuracy, and data cleaning as measures.

Think about it, and if your score isn’t where you want it to be, this is the perfect time to start practicing more often.

My Final Thoughts

See, preparing financial statements isn’t just a technical task, it’s a responsibility.

It’s where your work becomes visible, measurable, and valuable.

Once you understand how each statement connects and supports the others, you’ll not only create reports, you’ll actually be able to tell the story of a business with accuracy and confidence.

I hope this small blog helped you get more clarity on the Components of Financial Statements.

👉 If you want to strengthen your fundamentals and grow with a supportive community of professionals, I invite you to join The Accountant Hub VIP Group today. Here’s the link : VIP

Keep Learning, Keep Growing 1% every day.

Divyesh Dave